The Permian Premium: Are Recent High Prices Justified?

Tuesday October 18, 2016

- Activity in the Permian is high by all measures except new lease filing.

- Asset transactions involving Permian acreage ranged from $10,00 to $58,000 per net acre in 2016.

- Analysis of Wolfcamp B type curve production for recent long lateral wells in Martin County suggests land NPV from $52,000 to $269,000 per acre at $30 and $80 per barrel, respectively.

- NPV and acreage valuation estimates are sensitive to the decline curve model used to forecast production.

- Pioneer Wolfcamp B wells drilled in Martin County have a breakeven oil price of $21.40 per barrel, including land acquisition costs. Specify that this is for the new acreage.

- Because of more expensive land acquisition costs, the breakeven oil price for QEP in Martin County would be $31.50 per barrel.

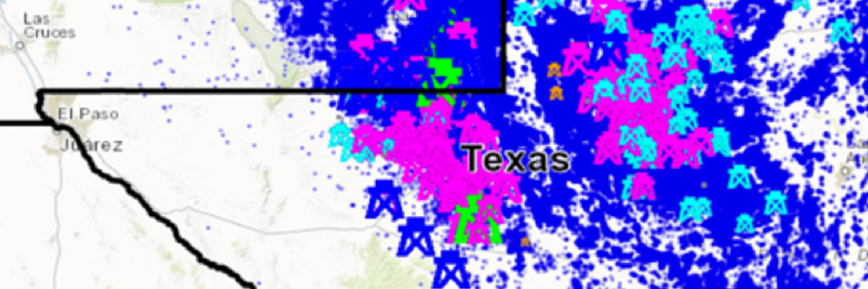

Activity in the Permian is higher than in any other U.S. resource play by nearly all measures. A quick look at nationwide rig counts shows ten of the top fifteen counties are in the Permian. Eight of the top fifteen counties for new drilling permits approved within the last six months are in the Permian. And eight of the top fifteen counties for wells with first production within the last 12 months are in the Permian. The only category in which the region does not figure prominently is leasing. It boasts only four of the top fifteen counties for lease filings within the last six months, with most of those on the edges of the play.